For those with short attention spans who dont want to read to the end of the article, Ill cut straight to the chase: China has much more gold than it says it does. In fact, China has more gold than the US. Its enormous gold hoards are all part of its grand global reserve currency status designs.

Right. Time to back up those assertions. Lets do an audit. Audits involve a lot of numbers and too many numbers can get a little overwhelming, so I will try to keep them to a mentally-digestible minimum. But let me start with perhaps the contextual figure and anchor that in your minds US gold holdings. Official records show the US owns some 8,133 tonnes, most of it in Fort Knox. It is the world's largest owner (or so you thought) and gold comprises 77% of its official foreign exchange reserves.

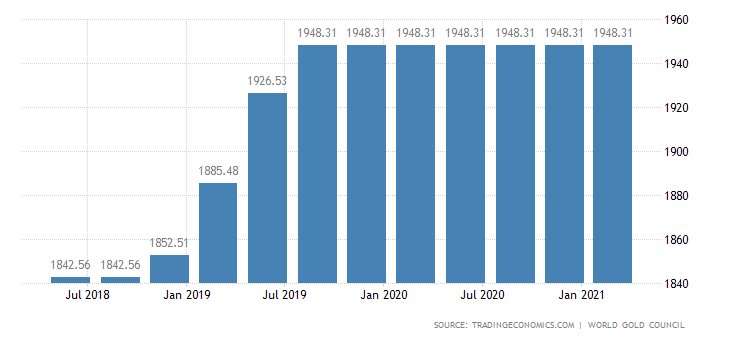

Chinas officially declared holdings of 1,948 tonnes make up just 3% of its $3.2trn in foreign exchange holdings, but the real number is much larger than that. China has been the worlds largest gold producer since 2007 this past decade it has produced about 15% of all the gold mined in the world; last year it produced 380 tonnes thats 20% more than the worlds second-largest producer, Australia.

Since 2000, China has mined roughly 6,500 tonnes. More than half of Chinese gold production is state-owned; the China National Gold Group Corporation alone accounts for 20%. Already that official 1,948 figure looks doubtful. Crucially, China keeps the gold it mines exporting of domestic mine production is not allowed.

With reserves in decline at home, Chinese mining companies have also been buying assets abroad, across Africa, South America and Asia. International production exceeded domestic production by about 15 tonnes last year. As well as being the worlds biggest producer, China is the worlds biggest importer. It is hard to get precise import figures, but we do know that, for example, via Hong Kong alone, over 6,000 tonnes has entered the country since 2000. Add that to cumulative gold production since 2000 and you get a figure of 13,200 tonnes.

Whether imported, mined or recycled, most of the gold that enters China goes through the Shanghai Gold Exchange (SGE), including the gold imported from Hong Kong. So SGE withdrawals for which we do have numbers can act as something of an approximation for demand. And it is possible to get numbers for SGE withdrawals: since 2008, roughly 20,000 tonnes have been withdrawn from the SGE.