GoldCompany

Michael Cohen

- Joined

- Mar 21, 2013

- Messages

- 78

- Reaction score

- 43

Respected Citigroup strategist Tom Fitzpatrick said in a telephone interview from New York with Bloomberg that gold and silver should surge in the coming years as the precious metals continue to benefit from the easy monetary policies adopted by central banks.

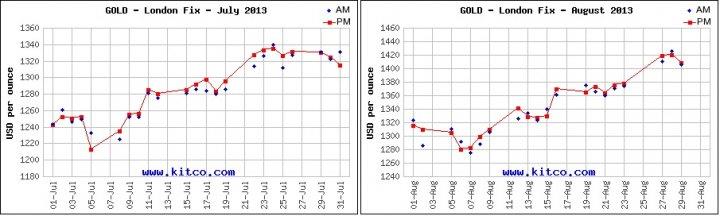

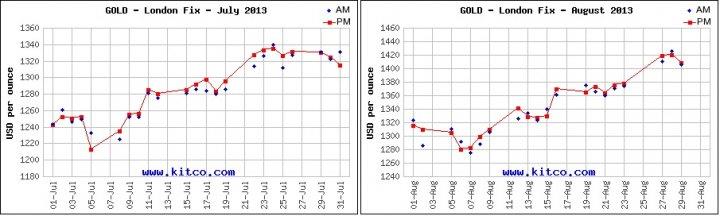

Fitzpatrick, who has a good track record, said that gold has put in a low for the year and will rise to about $1,500-$1,525/oz this year. A gain of over 6.3% from todays prices.

He said that silver is in a strong uptrend and will likely outperform gold as the gold silver ratio will drop from its current level at 58.1.

Separately, in an interview with King World News Eric King, Fitzpatrick elaborated on why he believes gold could reach $US3,500:

So we believe we are back into that track where gold is the hard currency of choice, and we expect for this trend to accelerate going forward. We still believe that in the next couple of years we will be looking at a gold price of around $US3,500.

As the gold/silver ratio plummets near 30, this would also suggest a silver price above $US100.

We are about to see the next run on physical bullion.

Buy as much as you can !

Cheers

Mike

Fitzpatrick, who has a good track record, said that gold has put in a low for the year and will rise to about $1,500-$1,525/oz this year. A gain of over 6.3% from todays prices.

He said that silver is in a strong uptrend and will likely outperform gold as the gold silver ratio will drop from its current level at 58.1.

Separately, in an interview with King World News Eric King, Fitzpatrick elaborated on why he believes gold could reach $US3,500:

So we believe we are back into that track where gold is the hard currency of choice, and we expect for this trend to accelerate going forward. We still believe that in the next couple of years we will be looking at a gold price of around $US3,500.

As the gold/silver ratio plummets near 30, this would also suggest a silver price above $US100.

We are about to see the next run on physical bullion.

Buy as much as you can !

Cheers

Mike