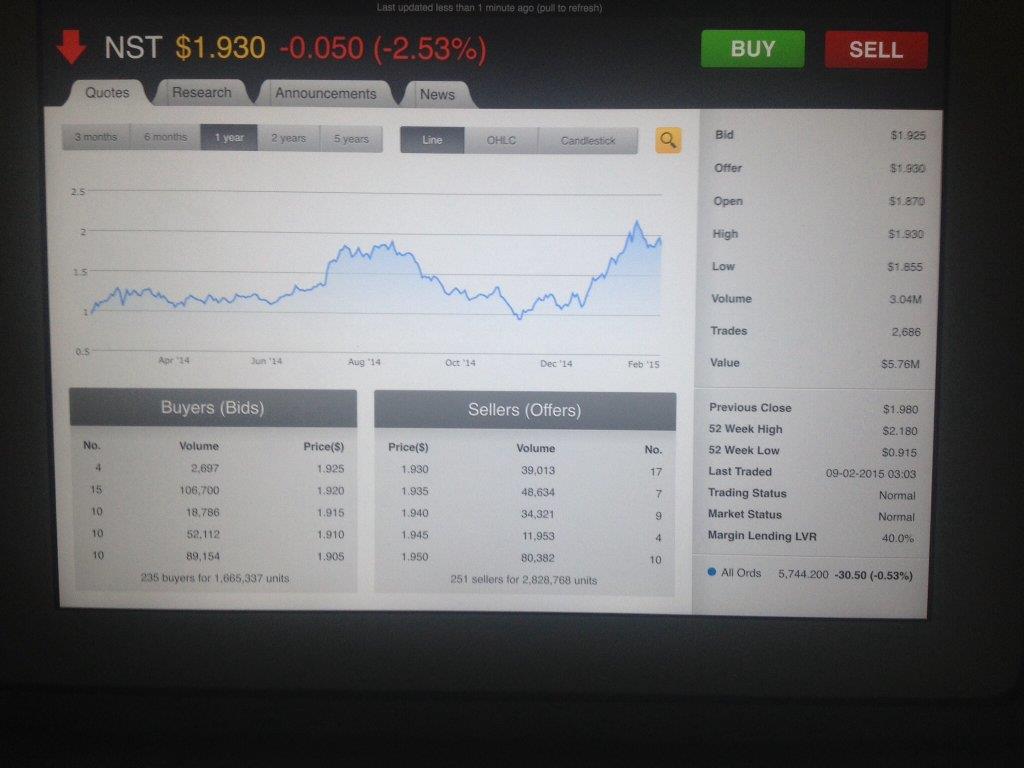

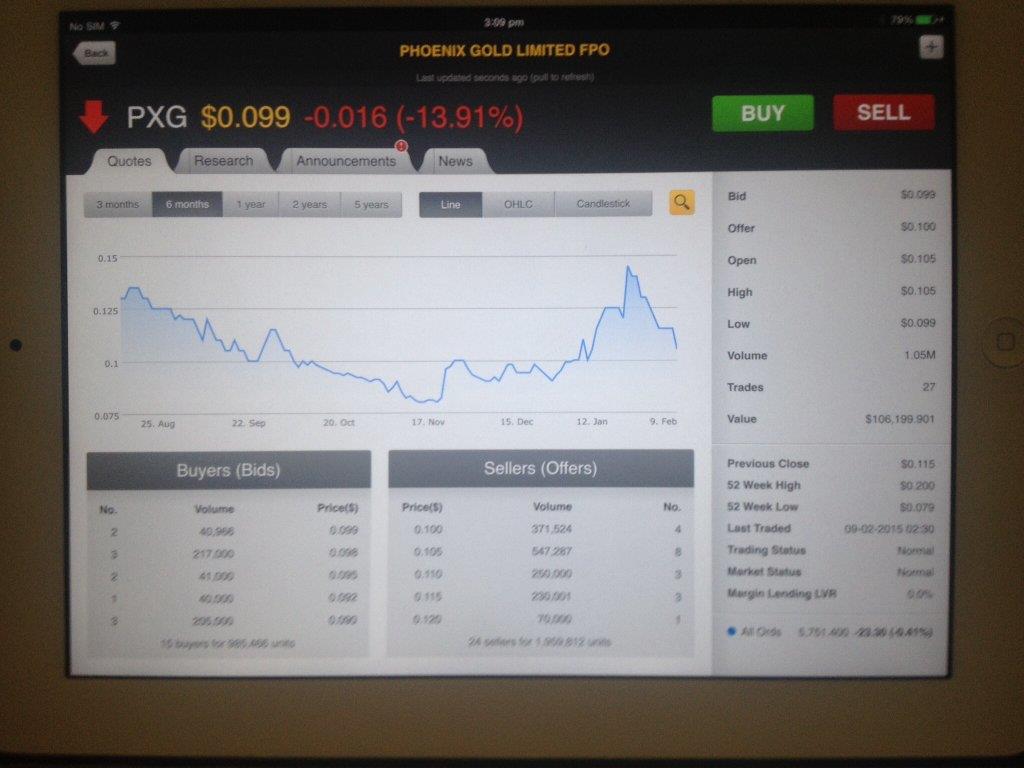

I am hoping that there is somebody with expertise in report analysis. I trade commodity stocks which

currently include many small gold stocks , my trading is based entirely on fundamentals and charting , so any reports sent

on exploration or production in gold are above my head . Type of report posted below , however I would not know if this was good , bad or indifferent, comment or PM appreciated

Discovered 9 months after Spargoville Project acquisition through exploration based on Wattle Dam Model Drill Closer and Deeper

RC drilling has highlighted three gold mineralised zones at the Redback Prospect

High grade mineralisation has now been intersected over a collective strike extent of 100 metres and remains open in several directions

Highly anomalous results in the Eastern Zone include:

4m @ 7.46g/t Au from 113m incl 1m @ 18.2g/t Au

3m @ 17.5g/t Au from 95m incl 1m @ 33.5g/t Au

16m @ 6.00g/t Au from 118m incl 4m @ 15.3g/t Au

7m @ 9.98g/t Au from 109m incl 2m @ 18.5g/t Au and 1m @

19.4g/t

Highly anomalous results in the Central Zone include:

2m @ 27.3g/t Au from 161m incl 1m @ 53.6g/t Au

7m @ 3.74g/t Au from 65m incl 2m @ 9.76g/t Au

[email protected]/[email protected]/tAuand1m@

13.4g/t Au

Highly anomalous results in the Western Zone include:

9m @ 4.78g/t Au from 170m incl 4m @ 9.05g/t Au

13m @ 3.16g/t Au from 188m incl 2m @ 6.52g/t Au

20m @ 4.05g/t Au from 195m incl 2m @ 12.1g/t Au

6m @ 4.47g/t Au from 124m incl 1m @ 14.3g/t Au

Follow up and Infill, 15 RC/Diamond hole, 3000 metres drill programme planned to commence during February 2015

Tychean Resources Limited Investor Presentation February 2015 7

currently include many small gold stocks , my trading is based entirely on fundamentals and charting , so any reports sent

on exploration or production in gold are above my head . Type of report posted below , however I would not know if this was good , bad or indifferent, comment or PM appreciated

Discovered 9 months after Spargoville Project acquisition through exploration based on Wattle Dam Model Drill Closer and Deeper

RC drilling has highlighted three gold mineralised zones at the Redback Prospect

High grade mineralisation has now been intersected over a collective strike extent of 100 metres and remains open in several directions

Highly anomalous results in the Eastern Zone include:

4m @ 7.46g/t Au from 113m incl 1m @ 18.2g/t Au

3m @ 17.5g/t Au from 95m incl 1m @ 33.5g/t Au

16m @ 6.00g/t Au from 118m incl 4m @ 15.3g/t Au

7m @ 9.98g/t Au from 109m incl 2m @ 18.5g/t Au and 1m @

19.4g/t

Highly anomalous results in the Central Zone include:

2m @ 27.3g/t Au from 161m incl 1m @ 53.6g/t Au

7m @ 3.74g/t Au from 65m incl 2m @ 9.76g/t Au

[email protected]/[email protected]/tAuand1m@

13.4g/t Au

Highly anomalous results in the Western Zone include:

9m @ 4.78g/t Au from 170m incl 4m @ 9.05g/t Au

13m @ 3.16g/t Au from 188m incl 2m @ 6.52g/t Au

20m @ 4.05g/t Au from 195m incl 2m @ 12.1g/t Au

6m @ 4.47g/t Au from 124m incl 1m @ 14.3g/t Au

Follow up and Infill, 15 RC/Diamond hole, 3000 metres drill programme planned to commence during February 2015

Tychean Resources Limited Investor Presentation February 2015 7